This advice will give you a few tips to help you along the way.

TIP #1 Diamonds are usually given to display love, making the sentimental value higher to the seller than the actual value to a buyer. Should you be in the market to sell your diamond, make sure you are ready to part with the diamond before beginning the process.

TIP #2 Be sure of the quality and authenticity of what you are trying to sell. Make sure of the quality and the grade of the stone. This is most important for the ultimate value of the diamond. There have been many instances where a seller is committed to selling their diamond only to find out the quality isn’t as described when originally purchased.

There are Jewellers or services available, who will give an unbiased assessment of your stone. But it is far more valuable in the long run to get a report from a recognised Laboratory.

It is also recommended to verify the report matches the Laser inscription before placing your diamond on the market, to assure your diamond is the same stone should it not sell.

TIP #3 Now that you have an accurate report of the quality, make sure you get a realistic selling value. Believing the diamond holds a higher value than it truly possesses will lead to a challenging, frustrating experience which can be dragged out.

An appraiser can assist you with determining a fair selling, price so you can avoid this pitfall. Diamonds are priced in US dollars, so your diamonds price will be affected when converted to your local currency.

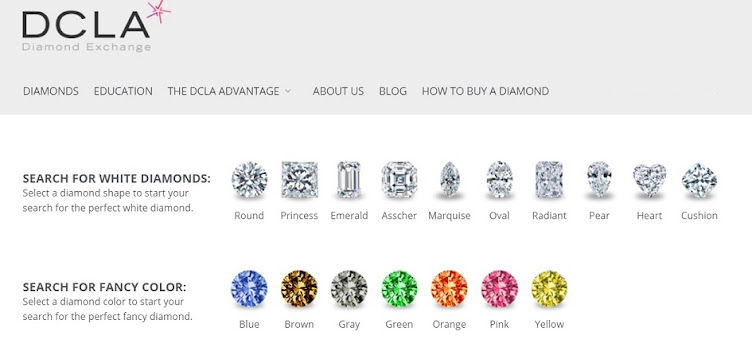

A good way to see current retail values is to visit online stores like dcladiamondexchange.com.au or bluenile.com.

TIP #4 There are many ways to sell a preloved diamond or diamond jewellery. Research your selling options to make an educated decision that works best for you. Be it an online market or exploring options through a local jeweller or dealer, be sure you are using the best option for your needs.

Example, if time is not of the essence, an online market or an auction house could be the best way forward. If you want a quick sale, visiting your local dealer may be the best option.

DCLA Diamond Laboratory provides an internationally recognised and respected report to any seller or prospective buyer.

DCLA will provide you with an experience expert to advise you and give you the accurate value protecting you when selling. Our goal is to provide you with as much knowledge as possible.

Visit www.dcla.com.au for information advice or to make an appointment.