Sir Gabriel “Gabi” Tolkowsky, one of the world’s most revered diamond cutters, has died at 84, friends and family wrote on social media on Monday.

Born in Tel Aviv in 1939, Tolkowsky was from a family steeped in the diamond industry. He learned the trade from father, Jean, who had a diamond-polishing factory in Israel — an education that would set him up for a career manufacturing some of the world’s most famous diamonds.

“Every day after work, [my father] would come home from his workshop with people from all over the world who had come to learn about diamond polishing and sit in the one big living-cum-bedroom-cum-dining room we had,” Tolkowsky said in a 2008 interview with Singapore’s The Straits Times.

Jean Tolkowsky and his cousin had moved from Antwerp to Palestine — now Israel — in 1932, Gabriel Tolkowsky told Martin Rapaport in 2000. Jean became the first person to install a polishing operation in the country.

“To polish diamonds, he had to use a bicycle to turn the polishing wheel, because there was no electricity,” he said. “Many of the first diamond people in Israel were my father’s pupils. I learned my trade from him, and I am proud to have had such a rare opportunity.”

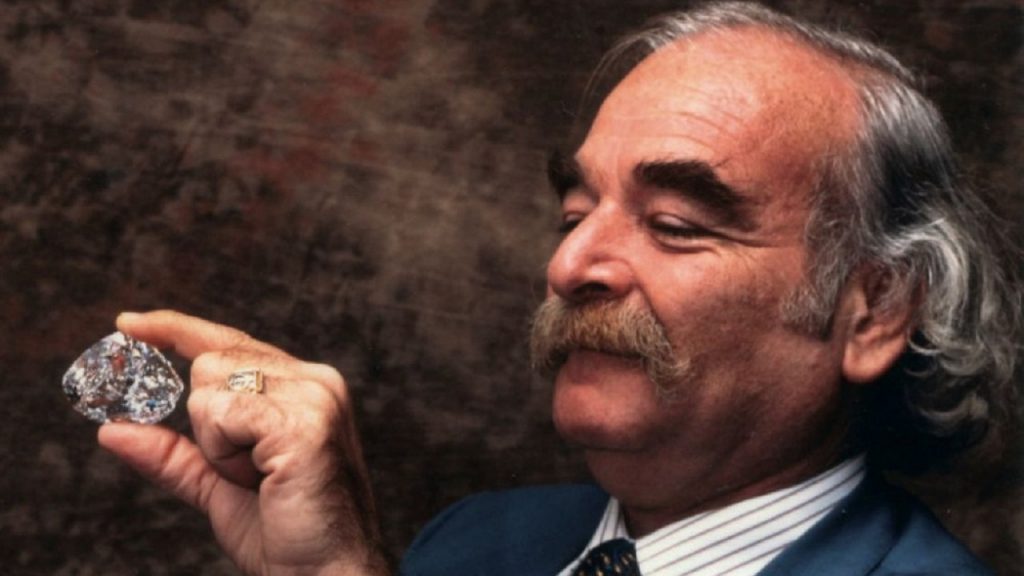

From 1975 until 1995, Gabriel Tolkowsky worked for De Beers’ now-defunct manufacturing unit, Diatrada. He was famous for cutting the 273.85-carat Centenary Diamond, which De Beers unveiled in 1991 to mark 100 years since the company was founded.

For months, he “just studied it,” Tolkowsky said in the 2000 interview. “I looked at it during the day; I looked at it at night. I looked at it during the day, and at night it looked at me! I couldn’t sleep, because I was looking for answers.”

After De Beers announced he would polish the stone, he and his wife had to hide from news reporters and ended up staying in an unlisted room in the basement of a remote hotel in Cape Town, according to The Straits Times. He subsequently spent three years cutting the diamond in a high-security underground facility. The polished piece later went on display at the Tower of London. He also cut the 545.67-carat Golden Jubilee Diamond for De Beers.

The Centenary Diamond. (De Beers)

“He always believed that diamonds are not a commodity but rather a unique way of expressing emotions,” said Marc-André Zucker, a board member at Antwerp’s rough-diamond bourse, the Antwerpsche Diamantkring. “His enthusiasm was endless — he was truly ‘romancing’ diamonds.”

Part of a well-known diamond family, he was the great-nephew of Marcel Tolkowsky, the inventor of the ideal-cut round brilliant diamond.

In 2002, he received a Knighthood Chevalier de L’ Ordre du Roi Leopold II from the Belgian government for his contribution to the diamond industry.

He was a “pioneer and a master craftsman who understood the wonder of diamonds like few other people,” said a spokesperson for De Beers. “Gabi combined artistry, expertise and passion to create some of the most beautiful and famous polished diamonds in history. He will be greatly missed, and all our thoughts are with the Tolkowsky family.”

Source: DCLA