De Beers, the world’s top diamond producer by value, saw sales jump by 18% in the second cycle of 2022 compared to the same period last year, attesting to the industry’s consolidated recovery from the first pandemic-induced shutdowns.

The Anglo American unit sold $650 million of diamonds between February 21 to February 25, down $10 million from the first cycle of the year, but higher than the $550 million it sold in the second cycle of 2021.

De Beers sells its gems through 10 sales each year in Botswana’s capital, Gaborone, and the handpicked buyers known as sightholders generally must accept the price and the quantities offered.

Customers are given a black and yellow box containing plastic bags filled with stones, with the number of boxes and quality of diamonds depending on what the buyer and De Beers agreed to in an annual allocation.

The company said that owing to the restrictions on the movement of people and products in various jurisdictions around the globe, it has continued to implement a “more flexible approach” to selling roughs, which included extending the latest sight event beyond its normal week-long duration.

The miner, which has benefitted from a steady recovery in the diamond market, is said to have hiked prices by about 8% in January. It had already increased the price of its rough diamonds throughout much of 2021 as it sought to recover from the first year of the pandemic when the industry came to a near halt. Most of these hikes, however, were applied to stones bigger than 1 carat.

The strategy granted De Beers a steady recovery during 2021. Its diamond prices rose by 23% in “just over a year,” said Mark Cutifani, CEO of Anglo American in a December presentation.

Russia-Ukraine effect

De Beers may benefit from the sanctions imposed to Russian companies as Moscow-based Alrosa (MCX: ALRS), the world’s top diamond miner by output, is its main competitor.

Alrosa and its chief executive Sergei S. Ivanov were included in the first wave of restrictions announced by the US Department of the Treasury’s Office of Foreign Assets Control (OFAC), which targeted mainly banks and energy firms.

Data from the US Treasury shows Alrosa is responsible for 90% of Russia’s diamond production and 28% of global supply.

De Beers chief executive Bruce Cleaver said the company has been “shocked” and “saddened” by the war in Ukraine, so it will donate $1 million to aid organizations operating in the region and providing support to those affected by the ongoing conflict.

Experts believe that The Kremlin will soon be unable to pay its debts amid increasing international sanctions against Russia.

Credit ratings agency Fitch Ratings has downgraded its view of the country’s government debt, warning a default is “imminent” for the second time this month.

“The further ratcheting up of sanctions, and proposals that could limit trade in energy, increase the probability of a policy response by Russia that includes at least selective non-payment of its sovereign debt obligations,” the agency said.

Moscow has told investors that it will continue to service its sovereign debt but warned that international sanctions imposed on its energy industry could limit its ability and willingness to meet its obligations.

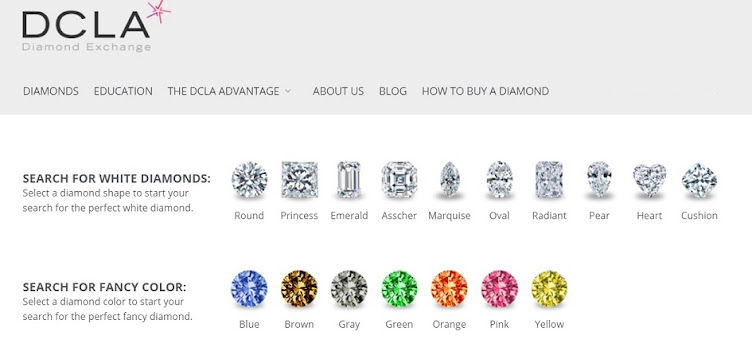

Source: DCLA