Botswana is bracing for deeper spending cuts and a widening budget deficit as a prolonged slump in diamond demand pressures its economy, even as the country signals interest in expanding its stake in diamond giant De Beers.

Vice President and Finance Minister Ndaba Gaolathe said the government is preparing to make “drastic” fiscal adjustments to stay afloat, including slashing expenditures and boosting tax revenues.

“The first thing we need to do, obviously, is to live within our means,” Gaolathe said in Washington. “That means cutting spending — doing away with what we believe is some of the fat.”

Diamonds make up a third of Botswana’s revenue and lead its exports, but a prolonged drop in global demand since mid-2023 has forced the government to raise its budget deficit forecast to 9% of GDP — the highest since the pandemic. The downturn has also led to a 3% contraction in the economy this year.

With foreign reserves under pressure, officials plan to cut costs by trimming the government vehicle fleet and curbing travel. They’re also moving to boost revenue through stricter tax enforcement and a new digital transaction levy set to launch in September.

Despite fiscal stress, Gaolathe said Botswana is reluctant to seek financing on international markets, preferring concessional loans. “Let’s borrow where it’s cheapest,” he said.

Bigger De Beers stake

The diamond downturn has also accelerated changes in the industry. Anglo American (LON: AAL), which owns 85% of De Beers, has been seeking a buyer for the iconic diamond company. Botswana, which holds the remaining 15% and is De Beers’ primary diamond source, says it wants a greater say in the sale.

“We are very confident that partners are coming forward,” Gaolathe told Bloomberg, noting interest from countries, funds and companies with “deep interest” in the industry. Botswana wants any new owner to be financially strong and committed to the diamond business long-term — and said it is open to increasing its stake to as much as 50%.

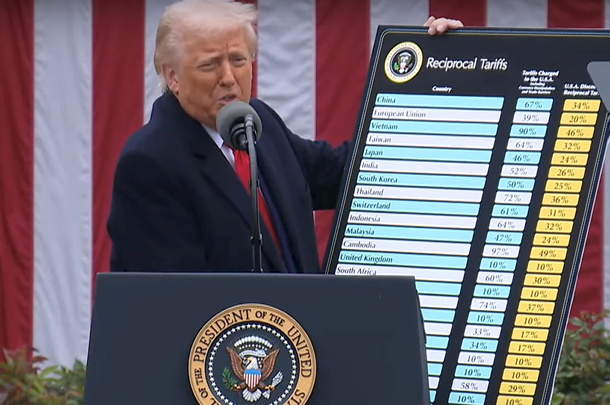

The government and De Beers recently signed a 10-year deal to fund global marketing aimed at reviving demand for natural diamonds, which have been losing ground to lab-grown alternatives. New US tariffs on Botswana’s diamonds have since added uncertainty to any near-term rebound.

“High tariffs on our diamonds will have a deleterious effect on us,” Gaolathe warned. The Bank of Botswana expects only a “muted recovery” this year.

Source: Mining.com