Fancy colour diamonds saw slower growth in the last three months, with an increase of just 0.5 per cent in the FCRF Index, which tracks prices across all colours, sizes and intensities.

That compares with a 1.3 per cent rise during the first quarter of 2023, as reported by the New York-based Fancy Colour Research Foundation, with the biggest increases among yellows.

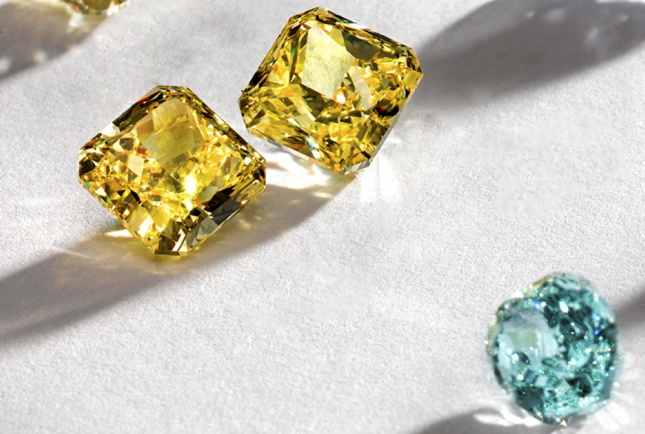

During Q2, yellows diamonds again drove the increase, with a rise of 6.5 per cent across all categories. Pinks were up 0.2 per cent and blues rose by 0.6 per cent.

The FCRF noted that fancy colour diamonds had again out-performed white diamonds, which saw prices fall 3.5 per cent during the quarter.

Board member Eden Rachminov said: “The first six months of 2023 were intriguing. We experienced notable spikes in certain sub-categories within the yellow category, particularly in the intense and vivid grades with a high inner-grade.

“Meanwhile, the blue and pink categories remained stable. If the world economy continues to maintain its positive momentum, we can anticipate a robust price behavior after the summer.”

The FCRF tracks pricing data for fancy colour diamonds in Hong Kong, New York, Geneva and Tel Aviv.

Source: DCLA