De Beers has sharply decreased its prices for select larger rough diamonds at this week’s sight, as the weak market has shown few signs of recovering.

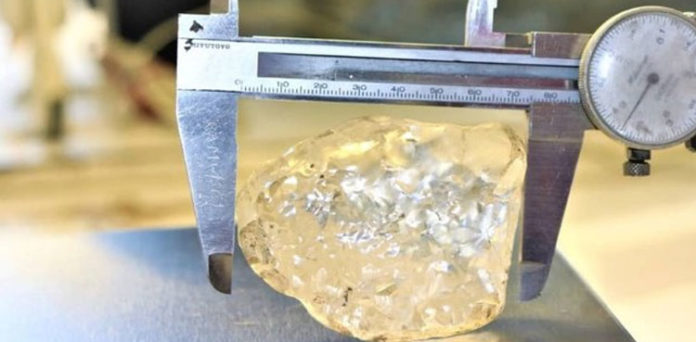

The price cuts range from 5% to 15% in several categories for stones 0.75 carats and up, with an emphasis on 2-carat diamonds and larger, industry insiders told Rapaport News on Monday. Some of these goods already saw price reductions last month, they noted, while the 15% cuts are in a handful of sluggish categories that the miner left untouched in June.

De Beers has focused its adjustments on the lower-quality items for which demand has been especially slow, the sources said on condition of anonymity. Polished sales in SI to I2 clarities have slumped this year due to the overall weakness of US retail — the main market for this range — as well as competition from lab-grown diamonds.

The company also maintained its policy of allowing 30% buybacks for certain low-performing items, the industry sources said. Buybacks let sightholders sell a proportion of the rough they’ve purchased back to De Beers, allowing them to offload the stones that will generate the least profit. The limit is usually 10%.

De Beers declined to comment on the price changes.

The July sight — the sixth of the year — began Monday and runs through Friday in Gaborone, Botswana. It is the first sight since De Beers and the Botswana government announced a new 25-year mining license and a 10-year sales agreement that will see state-owned Okavango Diamond Company (ODC) gain access to 50% of the country’s rough over the course of 10 years.

The June session saw sales fall 32% year on year to $450 million after De Beers slashed prices of many categories above 1 carat. The negative trends that were present then have continued into July, with the seasonal US summer slowdown compounding the situation. Many manufacturers in India have lowered their polished production to around 50% capacity in response to low sales and tight margins. They have shifted to smaller, lower-value rough to keep factories running.

However, even a 15% price drop for rough is not enough to solve the problem, one executive at a sightholder company said Monday. “[Polished] prices have fallen more than that over the last couple of months. More importantly, there’s still no [foreseeable prospect] of sales. We are all still waiting for the US to wake up.”

Source: rapaport