- Diamond grader Roy Cohen is urging Australians to get diamond rings engraved

- He argued a serial number on diamond girdle could stop illegal pawn shop sale

- Insurance premiums can also be reduced for jewellery inscribed with a code

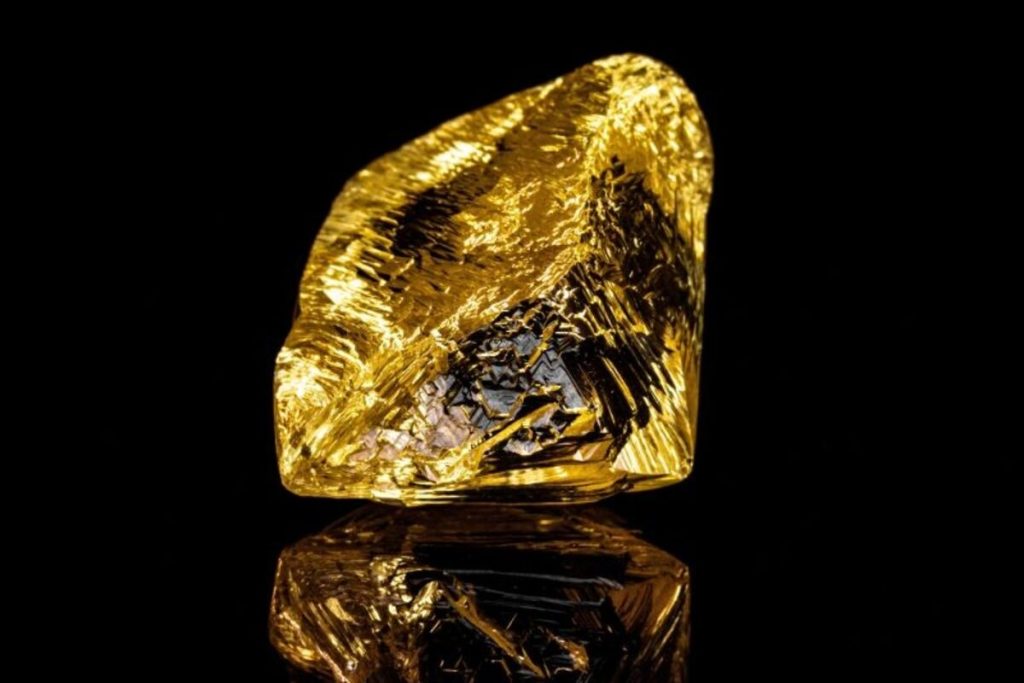

A romantic marriage proposal is a significant milestone in many people’s lives.

Engagement rings can also cost tens of thousands of dollars and are commonly stolen in home invasions.

Jewellery experts are urging engaged couples to get the girdle of the diamond engraved so they can’t as easily be pawned.

This microscopic serial number could be enough to get the ring returned, and save newlyweds potentially hundreds of dollars a year in insurance premiums.

Roy Cohen, a third-generation diamond grader originally from South Africa, said these minute inscriptions increased the chance of a stolen ring being reunited with its rightful owner.

‘It’s invisible to the naked eye, it can only be seen with magnification but it’s basically a serial number,’ he told Daily Mail Australia.

‘Usually what happens is, at any pawn shop, they will take a jeweller’s loupe and they will actually have a look at the item.

‘If there’s a certificate number on the girdle of the diamond and the diamond’s been sold without the certificate, usually that does raise alarm bells.’

Mr Cohen, the director of Diamond Certification Laboratory of Australia, said engraved serial numbers on diamonds could be checked against a database, arguing this was more effective than leaving a diamond un-engraved and relying on police detective work to find a stolen item.

‘If somebody steals a diamond ring from a house in Sydney and then goes to sell it in Melbourne, there’s no way that they’re going to get found out because there’s not a lot of co-operation between states,’ he said.

His DCLA company began inscribing diamond rings in Australia in 2001, following his move from Johannesburg to Sydney.

It has now formed a partnership with underwriter Woodina to form Certified Diamond Insurance, which only insures jewellery with an inscribed serial number.

Mr Cohen, who has three decades of experience as a diamond grader, vowed customers could save up to 50 per cent off their premiums compared to traditional home and content packages.

A diamond ring worth $10,000 can be insured for $306 a year.

Jewellery is the third most stolen item stolen from Australian homes, after cash and laptops, an analysis of official burglary figures by insurer Budget Direct found.

Source: DCLA