Canada’s Lucara Diamond has found an unbroken 341-carat white gem-quality rock at its prolific Karowe mine in Botswana, with analysts estimating it could fetch more than $10 million.

The Vancouver based miner said the diamond was recovered over the Christmas period from milling of ore coming from the south western quadrant of Karowe’s South Lobe.

The diamond is the 54th stone over 200 carats recovered at Karowe since it began commercial operations in 2012.

The find builds on previous historic recoveries which include the 342-carat Queen of the Kalahari, the 549 carat Sethunya, the 1,109 carat Lesedi La Rona found in 2015, and the 1758 carat Sewelô, recovered in 2019.

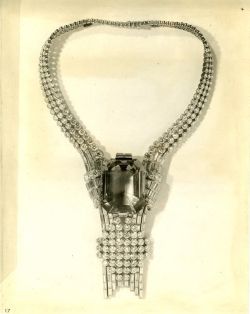

Beyond Sewelô, the only larger diamond ever unearthed is the 3,106 carat Cullinan Diamond, discovered in South Africa in 1905. The Cullinan was later cut into smaller stones, some of which now form part of British royal family’s crown jewels.

Source: DCLA