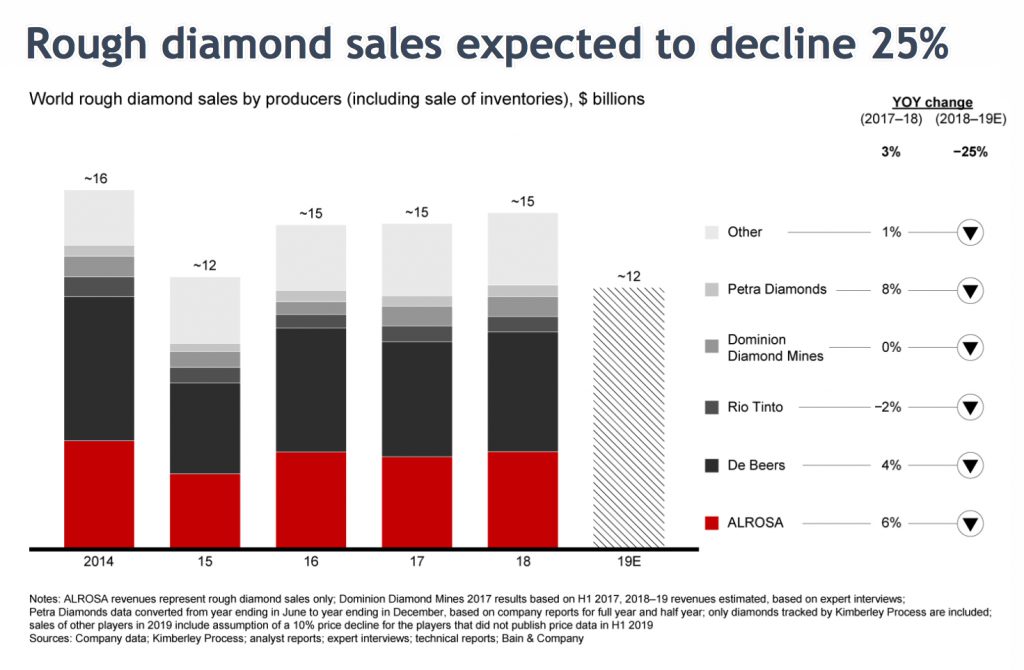

Anglo American’s De Beers, the world’s No.1 diamond miner by value, said on Wednesday that its last roughs sale of the year fetched $425 million, a slight improvement from the $400 million it obtained in the previous tender, but still over the year a whopping $1.4 billion less than in 2018.

The figure is also 20% lower than the $544 million worth of diamonds the miner sold in December last year, and it has brought the company’s total sales for 2019 to only $4 billion.

The diamond giant sells its stones ten times a year in Botswana’s capital, Gaborone. The buyers, or “sightholders,” usually accept the price and the quantities offered, but in the past months they’ve been given more decision making power, with De Beers allowing them to refuse about 50% of the stones contained in the parcels.

The company has also curbed plans to expand diamond production over the next two years and reduced prices for low-quality stones as much as 10%, in yet another sign of increasing volatility at the bottom end of the market.

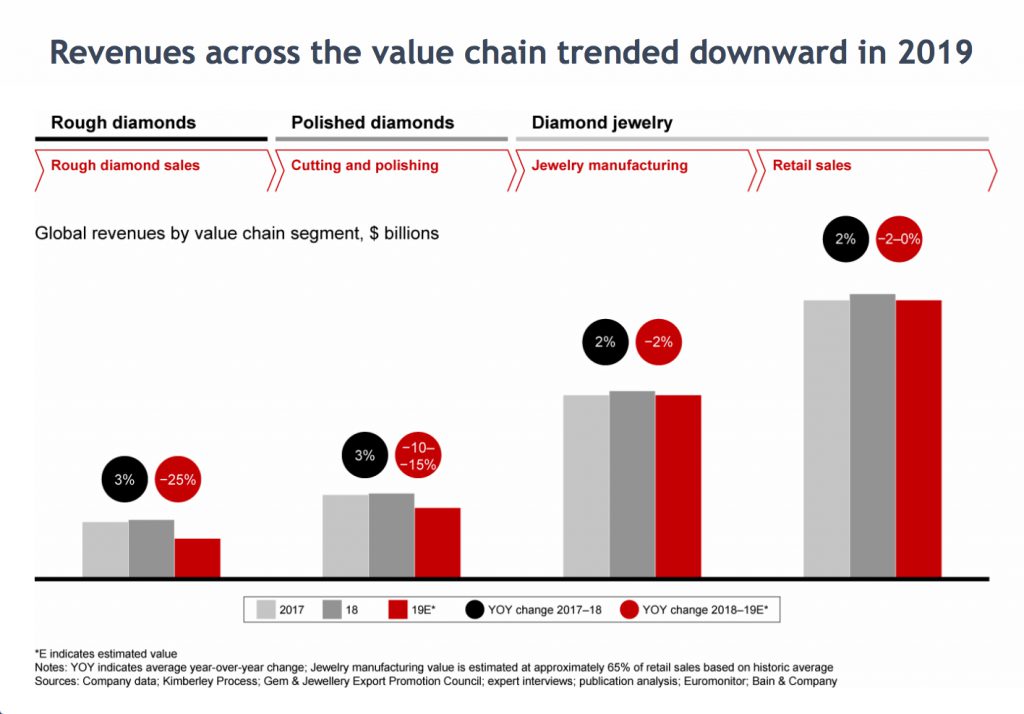

Cheaper diamonds, which are often small and low quality, have been selling for significantly less now than six years ago due to an unforeseen oversupply that has weighed on prices and producers’ bottom lines.

The situation, some key actors say, is about to change, as the first signs of stabilization in the sector are starting to appear.

“Following continued polished diamond price stability in the lead up to the final sales cycle of the year, we saw further signs of steady demand for rough diamonds during Sight 10,” De Beers chief executive officer, Bruce Cleaver, said in the statement.

His perception is shared by Russian competitor Alrosa (MCX:ALRS), which last week said it had “evidence” that prices for a variety of diamond products edged higher in October and November. The world’s top diamond producer by output also noted that prospects for de-stocking were “more visible.”

Industry consultant Bain & Co., however, believes that while the glut that’s depressing the diamond market will probably be cleared early next year, it will take at least another 12 months for the market to fully recover.

“The industry’s first and strongest opportunity to rebalance and regain growth will be 2021,” said Bain in a report, adding that supply could fall 8% that year.

Source: DCLA