Have a look at the bottom right corner of the US debt clock. The ratio of Physical Bullion to factitious paper bullion. It's no secret buy physical Silver and Gold ! http://www.usdebtclock.org

Monday, 26 March 2018

US debt

Have a look at the bottom right corner of the US debt clock. The ratio

of Physical Bullion to factitious paper bullion. It's no secret buy

physical Silver and Gold ! http://www.usdebtclock.org

Sunday, 25 March 2018

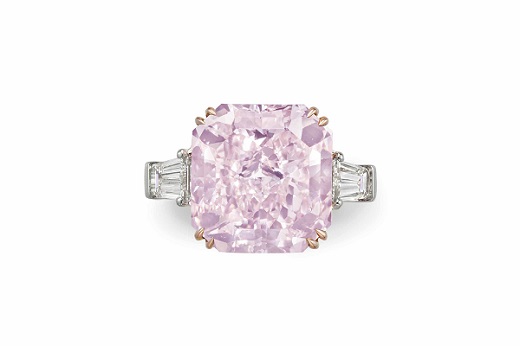

8ct Pink Diamond Ring to be Auctioned at Christie’s

Christie’s New York spring sale will feature an 8.42 carat, fancy intense pink diamond ring, estimated at between $4 million and $6 million, the auction house said Friday.

The cut cornered rectangular modified brilliant cut, VVS1 clarity stone has the potential to be re cut to internally flawless, according to Christie’s. Two tapered baguette cut diamonds surround it on either side.

Source: DCLA

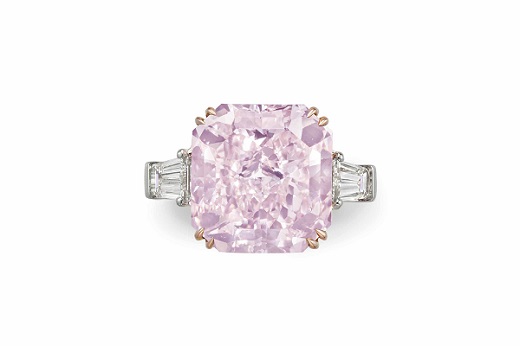

8ct Pink Diamond Ring to be Auctioned at Christie’s

Christie’s New York spring sale will feature an 8.42 carat, fancy intense pink diamond ring, estimated at between $4 million and $6 million, the auction house said Friday.

The cut cornered rectangular modified brilliant cut, VVS1 clarity stone has the potential to be re cut to internally flawless, according to Christie’s. Two tapered baguette cut diamonds surround it on either side.

Source: DCLA

Thursday, 22 March 2018

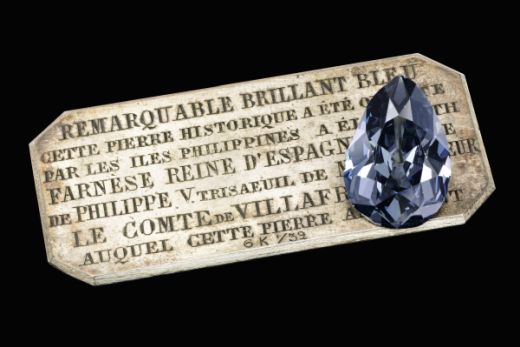

Royal Blue Diamond Surfaces After 300 Years

The pear-shaped, 6.16-carat, fancy dark grey-blue stone — originally given to Queen Elisabeth Farnese of Spain as a wedding gift following her marriage to King Philip V in 1714 — has spent 300 years in the private collection of Europe’s royal families. The diamond will go under the hammer at the Magnificent Jewels and Noble Jewels auction on May 15 with an estimated price of $3.7 million to $5.3 million. Originating in the Golconda mines of India, it has traveled from Spain to France, Italy and Austria over the last three centuries.

The family kept the diamond in a secret royal casket, and, other than family members and the royal jewelers, no one knew of its existence.

“With its incredible pedigree, the Farnese Blue ranks among the most important historic diamonds in the world,” said Philipp Herzog von Württemberg, chairman of Sotheby’s Europe and managing director of Sotheby’s Germany.

Queen Elisabeth passed the Farnese Blue to her son Philip, duke of Parma, whose son Ferdinand inherited it and passed it to his son Louis I, king of Etruria. Louis’s grandson, Charles II, duke of Lucca, passed it to his grandson, Robert I, the last ruling duke of Parma, who took the stone from Italy to Austria. He then mounted the stone on a diadem that had belonged to his mother, Louise Marie Thérèse of Artois. Upon the death of Robert I, the stone passed to his son Elias of Bourbon, duke of Parma. His wife, Maria Anna von Habsburg — who died in 1940 — recorded the stone’s history.

The Farnese Blue will appear at Sotheby’s in Hong Kong, London, New York, Singapore and Taipei, before coming to Geneva for display prior to the sale.

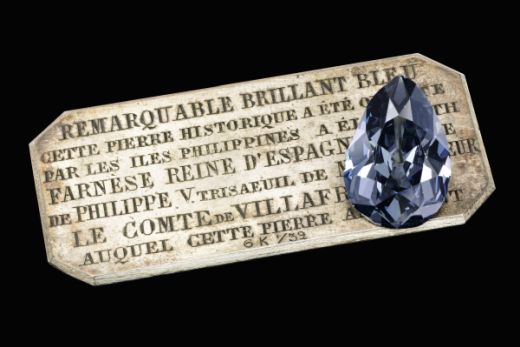

Royal Blue Diamond Surfaces After 300 Years

The pear-shaped, 6.16-carat, fancy dark grey-blue stone — originally given to Queen Elisabeth Farnese of Spain as a wedding gift following her marriage to King Philip V in 1714 — has spent 300 years in the private collection of Europe’s royal families. The diamond will go under the hammer at the Magnificent Jewels and Noble Jewels auction on May 15 with an estimated price of $3.7 million to $5.3 million. Originating in the Golconda mines of India, it has traveled from Spain to France, Italy and Austria over the last three centuries.

The family kept the diamond in a secret royal casket, and, other than family members and the royal jewelers, no one knew of its existence.

“With its incredible pedigree, the Farnese Blue ranks among the most important historic diamonds in the world,” said Philipp Herzog von Württemberg, chairman of Sotheby’s Europe and managing director of Sotheby’s Germany.

Queen Elisabeth passed the Farnese Blue to her son Philip, duke of Parma, whose son Ferdinand inherited it and passed it to his son Louis I, king of Etruria. Louis’s grandson, Charles II, duke of Lucca, passed it to his grandson, Robert I, the last ruling duke of Parma, who took the stone from Italy to Austria. He then mounted the stone on a diadem that had belonged to his mother, Louise Marie Thérèse of Artois. Upon the death of Robert I, the stone passed to his son Elias of Bourbon, duke of Parma. His wife, Maria Anna von Habsburg — who died in 1940 — recorded the stone’s history.

The Farnese Blue will appear at Sotheby’s in Hong Kong, London, New York, Singapore and Taipei, before coming to Geneva for display prior to the sale.

Thursday, 15 March 2018

Plane loses £263m cargo of gold and diamonds during take off

According to reports, the Nimbus Airline An 12 cargo plane’s hatch opened mid take off allowing the goods to fall out.

The incident occurred at Yakutsk airport in Eastern Siberia on Thursday, The Siberian Times reported.

Yakutsk is in Siberia’s diamond producing region.

Images appear to show the large bars scattered across the runway while another picture shows the large hole in the cargo section of the plane.

A spokesman told TASS: “A total of 172 gold bars weighing 3.4 tonnes have been found so far.”

Police sealed off the runway and a vast search is underway for the missing items.It’s thought that the cargo belonged to Chukota Mining and Geological Company. Canadian Kinross Gold have a 75 per cent share in the company.

An investigation is now underway as to how the hatch managed to open and whether any staff were involved in the incident.

Technical engineers at the airport have been detained.

Plane loses £263m cargo of gold and diamonds during take off

According to reports, the Nimbus Airline An 12 cargo plane’s hatch opened mid take off allowing the goods to fall out.

The incident occurred at Yakutsk airport in Eastern Siberia on Thursday, The Siberian Times reported.

Yakutsk is in Siberia’s diamond producing region.

Images appear to show the large bars scattered across the runway while another picture shows the large hole in the cargo section of the plane.

A spokesman told TASS: “A total of 172 gold bars weighing 3.4 tonnes have been found so far.”

Police sealed off the runway and a vast search is underway for the missing items.It’s thought that the cargo belonged to Chukota Mining and Geological Company. Canadian Kinross Gold have a 75 per cent share in the company.

An investigation is now underway as to how the hatch managed to open and whether any staff were involved in the incident.

Technical engineers at the airport have been detained.

Tuesday, 13 March 2018

“The Lesotho Legend” sells for $40 million

The world’s fifth biggest gem quality diamond ever found has sold for $40 million , the company that found the massive rough diamond reported.

Gem Diamonds mined the D colourType IIa rough diamond at its flagship Letšeng mine in Lesotho.

The Lesotho Legend was purchased by an anonymous buyer in Antwerp, the company said.

Prior to “The Lesotho Legend,” the largest rough diamond recovered at Letšeng was a 603 carat named Lesotho Promise.

Source: DCLA

“The Lesotho Legend” sells for $40 million

The world’s fifth biggest gem quality diamond ever found has sold for $40 million , the company that found the massive rough diamond reported.

Gem Diamonds mined the D colourType IIa rough diamond at its flagship Letšeng mine in Lesotho.

The Lesotho Legend was purchased by an anonymous buyer in Antwerp, the company said.

Prior to “The Lesotho Legend,” the largest rough diamond recovered at Letšeng was a 603 carat named Lesotho Promise.

Source: DCLA

Sunday, 11 March 2018

Type of ice found trapped in a diamond new to science

Ice VII inclusions found within diamonds is evidence for aqueous fluid in deep in Earth’s mantle.

The inclusions a high pressure form of water called ice VII present in diamonds sourced from between 410 and 660 km depth, the part of the mantle known as the transition zone.The transition zone is a region where the stable minerals have high water storage capacity.

The inclusions suggest that local aqueous pockets form at the transition zone boundary owing to the release of chemically bound water as rock cycles in and out of this region.

Ice VII is about one and a half times more dense than regular ice but unlike the other phases of ice ice VII remains fairly stable even as the pressure increases.

Source: DCLA

Type of ice found trapped in a diamond new to science

Ice VII inclusions found within diamonds is evidence for aqueous fluid in deep in Earth’s mantle.

The inclusions a high pressure form of water called ice VII present

in diamonds sourced from between 410 and 660 km depth, the part of the

mantle known as the transition zone.The transition zone is a region where the stable minerals have high water storage capacity.

The inclusions suggest that local aqueous pockets form at the transition zone boundary owing to the release of chemically bound water as rock cycles in and out of this region.

Ice VII is about one and a half times more dense than regular ice but unlike the other phases of ice ice VII remains fairly stable even as the pressure increases.

Source: DCLA

Wednesday, 7 March 2018

Gem Diamonds sixth large rough diamond for this year

The Letšeng Diamond Mine is having an extraordinary year this far as the miner continues to recover rough diamonds larger than 100 carats at its mine in Lesotho.

On Wednesday, the company announced it had recovered a 152 carat D colour type IIa diamond, the sixth exceptional large rough diamond so far this year.

Source: DCLA

Gem Diamonds sixth large rough diamond for this year

The Letšeng Diamond Mine is having an extraordinary year this far as the miner continues to recover rough diamonds larger than 100 carats at its mine in Lesotho.

On Wednesday, the company announced it had recovered a 152 carat D colour type IIa diamond, the sixth exceptional large rough diamond so far this year.

Source: DCLA

Sunday, 4 March 2018

Firestar Chief Speaks Out on Modi Crisis

The three jewelers — Firestar, A. Jaffe and Fantasy — are seeking an infusion of capital or a sale, and intend to continue business as normal in the meantime, their president, Mihir Bhansali, said in a court filing last week.

The companies have suffered a significant impact to their supply chains since accusations against Modi emerged last month.

The trio’s Chapter 11 process will “add a sense of order,” alleviate some of the concerns that its suppliers and clients have showed, and create a forum for potential purchasers of the businesses, Bhansali explained.

“Early expressions of interest in purchasing some of or all of the debtors’ business operations have been strong,” the executive said in the February 28 filing. “The debtors intend to act quickly and efficiently to determine which of the available restructuring options is in the best interests of the estates, and to preserve the…value of the debtors’ substantial business operations.”

Firestar and Fantasy are in talks with their banks about providing the liquidity the companies need to sustain their operations until they reach a sale, Bhansali continued.

A. Jaffe, which has no secured lenders — a term for those who get paid before other creditors — is also in discussions with suppliers and potential financing sources.

Source: DCLA

Firestar Chief Speaks Out on Modi Crisis

The three jewelers — Firestar, A. Jaffe and Fantasy — are seeking an infusion of capital or a sale, and intend to continue business as normal in the meantime, their president, Mihir Bhansali, said in a court filing last week.

The companies have suffered a significant impact to their supply chains since accusations against Modi emerged last month.

The trio’s Chapter 11 process will “add a sense of order,” alleviate some of the concerns that its suppliers and clients have showed, and create a forum for potential purchasers of the businesses, Bhansali explained.

“Early expressions of interest in purchasing some of or all of the debtors’ business operations have been strong,” the executive said in the February 28 filing. “The debtors intend to act quickly and efficiently to determine which of the available restructuring options is in the best interests of the estates, and to preserve the…value of the debtors’ substantial business operations.”

Firestar and Fantasy are in talks with their banks about providing the liquidity the companies need to sustain their operations until they reach a sale, Bhansali continued.

A. Jaffe, which has no secured lenders — a term for those who get paid before other creditors — is also in discussions with suppliers and potential financing sources.

Source: DCLA

Subscribe to:

Comments (Atom)

What Is Lab-Grown Gold? (And What It Really Means for Jewelry)

industrial gold waste from electronic components Lab-grown gold is often used as a marketing term to simply refer to recycled or recovered...

-

On a crisp winter morning in Panna, a historic diamond-mining region in central India, two childhood friends made a discovery they believe w...

-

A collaboration by Pandora, the world’s biggest jewelry brand, and the e-commerce platform Amazon, has smashed a sophisticated counterfeit...

-

A yellow diamond ring was the star of the most recent jewelry sale at Phillips in Hong Kong, fetching HKD 8.9 million ($1.1 million). The ro...