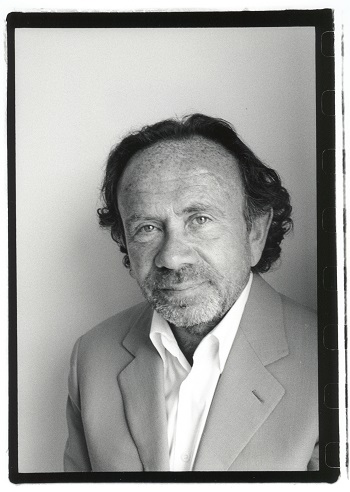

The diamond industry lost one of its most respected experts in large stones with the passing of Johnny Kneller last week at age 75.

Together with Brian Gutkin and Laurence Graff, Kneller was a partner in the manufacturing firm Safdico, where he handled some of the world’s most famous diamonds. Those included the Lesotho Promise, the Peace Diamond, and the Lesedi La Rona, his son-in-law Yves Alexis noted.

“He was an icon in the industry,” Gutkin stressed. “People sought his advice on large stones, colored diamonds, D-flawlesses because he had a unique understanding of these goods.”

And he was always happy to give of himself, Gutkin added. “It was impossible to walk with him through the Antwerp bourse, as people would gravitate toward him. Everyone loved him.”

Born in Prague, then in Czechoslovakia, in 1946, Kneller grew up in Antwerp and eased into the diamond trade through his father, who was a diamantaire and a De Beers sightholder specializing in large stones. Kneller also worked as a dealer and started traveling to South Africa to buy polished in the early 1980s. During that time, he met Gutkin and the two formed a partnership that became Safdico, Gutkin recalled.

Starting with only seven people, the company grew to become one of the most consistent sightholders for large goods. At its peak, Safdico employed 237 people at its Johannesburg factory and 120 in Botswana, according to Gutkin.

Kneller was extremely savvy in business and not averse to taking calculated risks, Gutkin and Alexis agreed. It was his initiative around 1998 to bring on board Graff, with whom he had a relationship and who had traded diamonds with Kneller’s father. The partnership made Safdico one of the first diamond manufacturers to forge an alliance with an established high-end jeweler.

“Johnny Kneller was a best friend as well as my business partner in our diamond-manufacturing business.” Graff wrote in a tribute provided to Rapaport News. “A man that put all others before himself, we were friends for 50 years and traveled together to Belgium, Africa and the US — and of course to many of the diamond sights.”

Kneller’s knowledge of the rough and polished diamond business was almost unmatched, Graff continued. “He had an uncanny way of discovering gems, in rough or polished, which ended up in our retail stores across the world,” he added.

Kneller’s eye for fine gems extended to art as well. He was a keen collector of contemporary works and had a solid background across many periods — a passion he shared with Graff.

But it was ultimately his expertise and love of diamonds that set him apart within the trade. “He really loved the stones, the material, to see the color [and] appreciate the cut, life and sparkle of the stones,” Alexis recalled.

His business partners echoed that sentiment.

“He lived and breathed diamonds all his life,” Graff concluded. “For me he was the greatest diamond dealer I have ever known.”

Kneller is survived by his wife, Delly, two daughters Katya and Julie, and six grandchildren.

Source: DCLA