The Angolan government introduced reforms to its diamond sector in the first half of the year to help boost foreign investment. Those measures included a new marketing policy for Angolan diamonds, and the option of offering goods for sale in locations such as Antwerp.

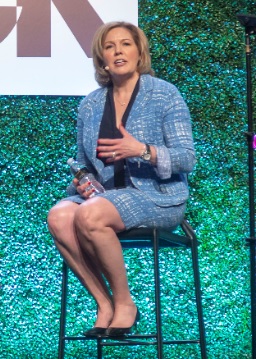

Anticipating the changes, Lucapa has been holding back a selection of large stones from previous sales, and will now sell them under the new policy, it explained Friday. These include six type IIa white diamonds weighing 114 carats, 85 carats, 75 carats, 70 carats, 62 carats and 43 carats, as well as a 46-carat pink diamond.

“The discussions with our Angolan partners regarding the policy changes taking place in the Angolan diamond sector have reached a stage where we are now able to plan for the sale of these large, premium-value Lulo diamonds held over from previous sales,” Lucapa managing director Stephen Wetherall said. “We look forward to marketing these exceptional diamonds as soon as the necessary arrangements are put in place to continue showcasing Angolan diamonds to the world.”

The decision to delay the tender for those stones had a negative impact on Lucapa’s first-half results, the company added. Its losses grew to $4.6 million for the period, versus a loss of $1.2 million a year earlier.

Even so, Lucapa’s sales rose 3% year on year to $15.9 million in the first half, while production for the same period climbed 15% to 9,566 carats. The average price of rough diamonds from Lulo rose 1% to $1,642 per carat. Rough-diamond inventory from the asset grew 61% year on year to 2,755 carats as of June 30, the miner reported.

Lucapa’s most recent sale of 2,531 carats of rough from Lulo fetched $2.5 million, achieving an average price of $985 per carat, the company noted.

Image: 46-carat pink Lulo diamond. Credit: Lucapa.

Source: DCLA