Las Vegas… Diamond market sentiment received a boost from the Las Vegas shows, which demonstrated robust US demand. However, polished prices declined amid a weak global economic outlook and a rise in inventory levels.

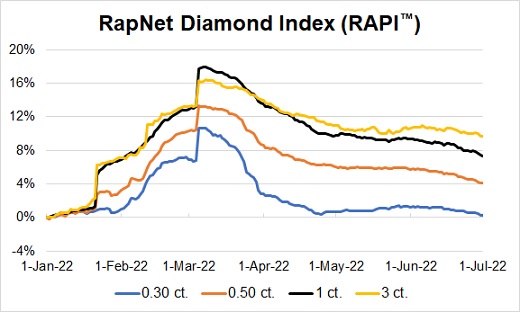

The RapNet Diamond Index (RAPI™) for 1-carat diamonds slid 1.8% in June but increased 7.4% between the beginning of the year and July 1.

| RapNet Diamond Index (RAPI™) | |||

|---|---|---|---|

| June | 1H 2022 | Year on year July 1, 2021, to July 1 2022 | |

| RAPI 0.30 ct. | -1.0% | 0.2% | -1.6% |

| RAPI 0.50 ct. | -1.6% | 4.1% | 5.0% |

| RAPI 1 ct. | -1.8% | 7.4% | 16.8% |

| RAPI 3 ct. | -0.8% | 9.7% | 22.2% |

Trading in Las Vegas reflected jewelers’ strong liquidity after a profitable 2021. Activity slowed once the fairs ended and dealers headed for vacations at the beginning of July.

There were also renewed fears of a recession; the US economy shrank 1.6% in the first quarter, and the latest data showed inflation at 8.5% in May. Consumer confidence dropped 4.5 points in June to its lowest level since February 2021, according to The Conference Board.

Chinese demand was low as well following Covid-19 lockdowns in April and May. The lack of buyers meant local jewelers had sufficient inventory for the short term.

Polished inventory in the midstream grew in June. The number of diamonds listed on RapNet rose 4.3% during the month to 1.87 million as of July 1. The high volume came despite the Russian sanctions that limited Alrosa’s rough sales and took an estimated 30% of global production off the market. Russian rough shortages are expected to impact polished supply in the coming months; manufacturers have so far been working with goods from before Russia’s invasion of Ukraine.

Other miners are capitalizing on the new rough-market dynamic. De Beers’ June sales rose 36% year on year to $650 million after a price hike of 8% to 10% on smaller rough — a category Alrosa usually dominates.

We predict that traceable, ethical diamonds will sell at a premium to Russian diamonds as Alrosa goods reenter the market. While US jewelers are upbeat after the shows, there are political and economic headwinds that will likely disrupt the industry in the second half.

Additional information is available at www.diamonds.net.

No comments:

Post a Comment