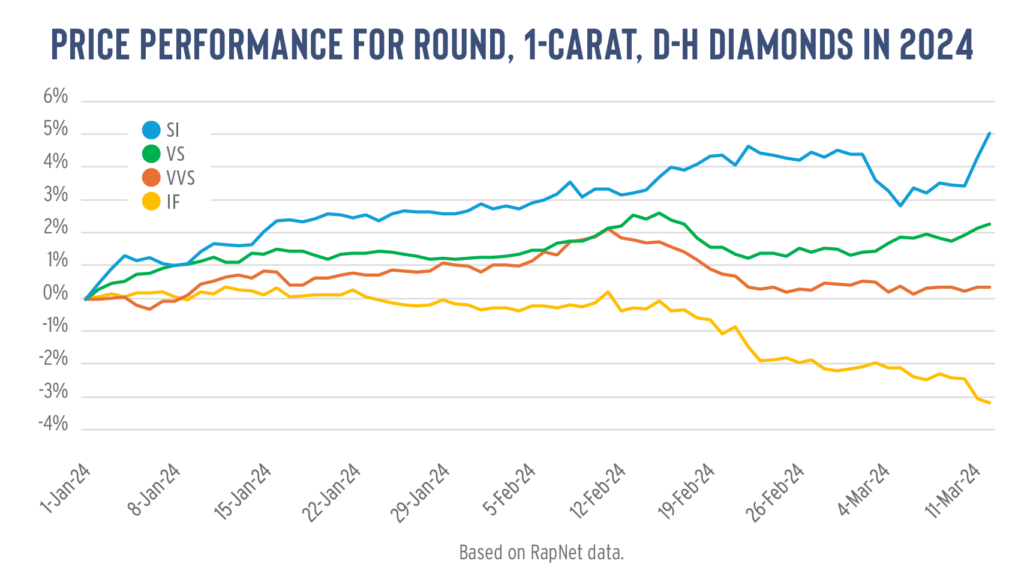

Prices of round, lower-clarity diamonds have performed better this year than their higher-clarity counterparts, as is clear from this graph showing the trend for 1-carat, D to H polished goods. Stones with SI clarity in those categories rose 5% for the period from January 1 to March 12, compared with a 2.2% increase for VS. VVSs slipped 0.4%, while prices of internally flawless (IF) goods fell 3.1%. The figures from RapNet reflect asking prices. Prices of fancies were down for the same period due to high inventories.

This is a correction from the situation in 2023, when prices of round, 1-carat, D to H, SI stones slumped 33% for the full year as consumers shifted from flawed naturals to eye-clean synthetics. The category has regained only some of that ground. Still, the improvement during those nearly two-and-a-half months has been considerable. Why has this happened, and why have higher clarities performed less strongly?

1. What goes down (faster) must come up (faster).

Having lost a third of their value in 2023, SI diamonds had more potential for a base effect going into 2024. By contrast, prices of round, 1-carat, D to H, VS diamonds fell 23% last year, with VVS and IF for the same range both falling 20%.

2. Lab-grown

The improvement in SIs reflects reduced pressure from lab-grown. Competition from synthetics is still there, but the impact appears to be easing. This is partly because price declines for lab-grown at retail have made them feel like less of a luxury product to consumers and damaged their appeal among jewelers. Retailers have the power to guide consumers toward whichever product gives them the most profit.

Last year, the damage to the lower-clarity segment in natural came largely from the fact that consumers could buy a lab-grown diamond with a higher color and clarity for the same or less money. SIs can have visible flaws if you pick the wrong one.

“The customers who wanted natural VS2 plus were never going to buy lab-grown,” said Ari Jain, chief financial officer at New York-based wholesaler House of Diamonds.

3. Impact of price decline and stabilization

Connected to the first two reasons is the fact that severe declines in prices of natural SIs in 2023 have made the category more affordable and therefore more popular for consumers. Jewelers, however, have a different consideration: The price stabilization for natural stones in the past few months has encouraged those who were investing in lab-grown to return to the mined product.

“Prices have come down over the course of 2023 to a place that made natural more attractive,” said Andrew Rickard, vice president of operations at Rochester-based wholesaler RDI Diamonds. “As they’re reverting back to natural, SIs still becomes the economic place to enter.”

4. High-end brands not buying

Many top luxury brands are not buying diamonds at the moment, several market sources observed. This inevitably affects the IF to VVS categories, the preferred clarities for these high-end houses.

The reason could be the state of consumer demand, especially in China, where purchasers lean toward higher clarities than in the US. One of the more compelling explanations is that high-end houses stocked up in 2023 because of concerns that a Group of Seven (G7) ban on Russian diamonds would raise prices of non-Russian production. They later realized that finding the right diamonds with confirmed origin was easier than they expected and are in no rush to add to their inventories.

Source: DCLA

No comments:

Post a Comment