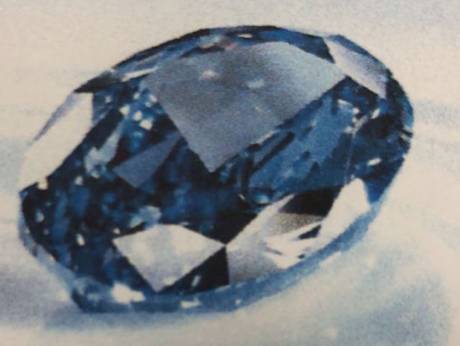

Botswana once again finds itself at a crossroads. The sparsely

populated, landlocked country is in a constant battle to ensure the

longevity of its diamond industry.

Recognizing that diamond mining will not last forever, the

government’s beneficiation program has sought to establish cutting and

polishing, trading, and auxiliary services in an effort to diversify its

industry — and economy — away from its reliance on the mining sector.

Beyond mining

De Beers, which counts around 59% of its production by value in

Botswana, has played no small part in that effort. It did so initially

by earmarking a part of its rough supply to be manufactured in Botswana,

and today there are 18 sightholders with factories in the country. In

2013, De Beers moved its sales headquarters to Gaborone, meaning that

its 10 annual sights were taken out of London, thus diverting traffic

and diamond-related activity to the African city.

Furthermore, the establishment of the parastatal Okavango Diamond

Company that same year gave the government access to 15% of production

by Debswana, its joint mining venture with De Beers. That was the first

time substantial rough sales from Debswana took place outside of the De

Beers system.

The 2011 agreement that governed those developments is up for renewal

in 2020, and negotiations are expected to begin in the coming year. For

its part, the government is seeking to increase supply to local

sightholders as a means of creating more jobs, newly elected President

Mokgweetsi Masisi told Bloomberg in May.

Some question whether Botswana can handle more manufacturing, given

that a few factories have closed in recent years. If profitability

remains the biggest challenge facing manufacturers, Gaborone has yet to

prove itself as a viable center for high-volume cutting. Perhaps De

Beers can play a further role there, too.

The government will also likely want to increase the percentage of

Debswana supply that Okavango receives. And it might want to renegotiate

greater access to the large and high-value diamonds Debswana recovers.

Digging deep

Botswana has some leverage in the relationship with De Beers. It owns a

15% stake in the group, with Anglo American holding the remaining 85%.

And the two are equal partners in Debswana and in DTC Botswana, which

sorts and mixes production for De Beers and Okavango.

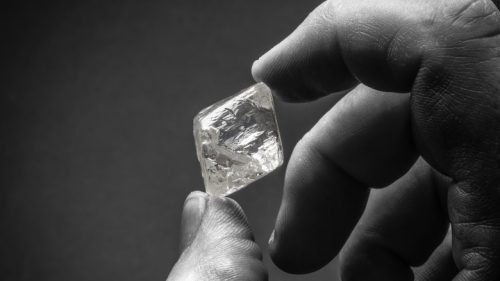

De Beers, meanwhile, brings to the table its mining expertise and

budget. In 2010, it committed to investing $3 billion over 15 years in

the Cut-8 expansion of the Jwaneng mine — considered the world’s most

valuable diamond-producing asset.

That project is already the main source of ore at Jwaneng and is

expected to extend the life of mine to 2030 and by some 93 million

carats. Studies for the viability of Cut-9 are under way, which would

further extend the life of Jwaneng. A final investment decision on the

project is expected later this year, reports a De Beers spokesperson.

De Beers could use the potential Cut-9 investment, as well as funding

extensions at the Orapa and Letlhakane mines, as a bargaining tool in

negotiations with the government.

African investments

De Beers walks a similarly fine line in other African countries where it operates.

In South Africa, it may have to reduce ownership of its local

businesses from 74% to 70% under the new mining charter, as the

government wants to see more local black economic empowerment (BEE)

involvement. That said, De Beers is engaged in a $2 billion project to

develop underground mining at the Venetia asset. From next year, Venetia

will be its only mine in South Africa, as it plans to close the

Voorspoed mine. It has already sold the Finsch, Cullinan and Kimberley

operations over the past decade.

Meanwhile, in May 2016, De Beers signed a 10-year sales agreement

with Namibia, in which it ceded 15% of local supply to the government

and promised more diamonds to local cutters. The company subsequently

announced major investments in its marine mining operations off the

Namibian coast.

It’s that give-and-take that Masisi is hoping will result in a

“win-win” for both parties as they negotiate their next long-term deal —

especially given that so much of Botswana’s future diamond production

depends on Jwaneng’s expansion.

“We have had a wonderful relationship with De Beers, and we expect

that relationship to be even more cemented,” the president told

Bloomberg in May. “The returns [from the Jwaneng development] are going

to be realized in the period of the next deal. This is a marriage we’re

after.”

Source:

DCLA