Alrosa has joined the collaborative programme being led by De Beers, Tracr, the end-to-end diamond industry blockchain traceability platform.

Alrosa will join industry leaders from the diamond manufacturing and retail sectors in creating the blockchain platform by the industry, for the industry.

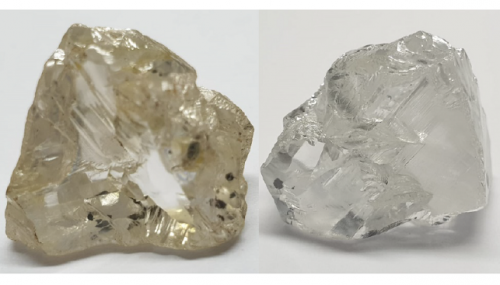

Following the announcement of the Tracr pilot earlier this year, Alrosa’s involvement brings the world’s two largest diamond producers together to provide enhanced assurance for consumers and trade participants about the provenance and authenticity of their diamonds, and in creating a digital foundation for new services that can only be developed on an end-to-end platform.

Bruce Cleaver, CEO, De Beers Group, says:

“To provide true traceability, diamonds must be tracked from their point of production. We are delighted that Alrosa has joined the Tracr pilot, as the collective efforts of the world’s two leading diamond producers will enable more of the world’s diamonds to be tracked on their journey from mine to retail.

“Having a critical level of production on the platform will deliver significant benefits for consumers and diamond industry participants.”

Sergey Ivanov, CEO, Alrosa, says:

“Traceability is the key to further development of our market. It helps to ensure consumer confidence and fill information gaps, enabling people to enjoy the product without any doubts about ethical issues or undisclosed synthetics.

“Alrosa is glad to participate in testing Tracr, along with other market solutions. We believe tracing requires industry cooperation and complementation for the sake of a common goal.”

Jim Duffy, General Manager, Tracr, says:

“As Tracr’s adoption grows, we will continue to raise the bar for the traceability, authenticity and provenance of diamonds.

“We look forward to working with all members of the industry to ensure we deliver a comprehensive platform that creates value for diamond businesses while meeting the consumer’s expectations.”

Tracr is focused on providing consumers with confidence that registered diamonds are natural and conflict-free, improving visibility and trust within the industry and enhancing efficiencies across the diamond value chain.

In addition, Tracr will work to complement and support the diamond industry’s existing initiatives and regulations to ensure consumer confidence in diamonds, including the Kimberley Process Certification Scheme, World Diamond Council System of Warranties and Responsible Jewellery Council Code of Practices.