The summit titled “Diamond & Jewellery Financing 2018 Mitigating Risks Efficiently” addressed the financial industry’s concerns about the diamond sector in the wake of recent fraud cases.

The new platform, released by the Antwerp World Diamond Centre (AWDC) and India’s Gem & Jewellery Export Promotion Council (GJEPC), will bring greater transparency to the diamond industry, and make regulatory compliance more efficient by helping with the due-diligence process, the Belgian organization said.

MyKYCBank is a global compliance platform for the diamond industry. Users can share KYC data with other companies located in Antwerp and India, as well as banks and other financial institutions, the AWDC explained.

“This initiative will improve confidence and boost lending to the sector, and…ensure better sharing of information and transparency and growth of this SME small and medium sized enterprise sector,” India’s Commerce Secretary Rita Teaotia said at the summit. “It is important for the banking sector to support the gems and jewelry industry, as it forms an integral part of the country’s gross domestic product.”

The new platform will lower compliance risks for banks, and improve confidence in the sector, said AWDC CEO Ari Epstein.

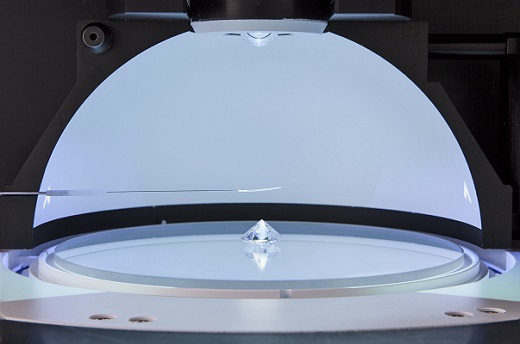

Source: DCLA