Botswana Diamonds said Tuesday that it recovered the first diamonds from plant commissioning activities on its Marsfontein mine in Limpopo, South Africa.

The announcement comes only days after it received a mining permit for diamond-bearing gravels and residual unprocessed stockpiles around the operation.

Chairman John Teeling said the plant was very close to reaching full operations following the installation of an in-field screen, two rotary pans, grease and x-ray recovery system.

“I am delighted with the rapid progress the team has made on-site and it is noteworthy that the first diamonds were recovered within two weeks of the mining permit being granted,” Teeling said.

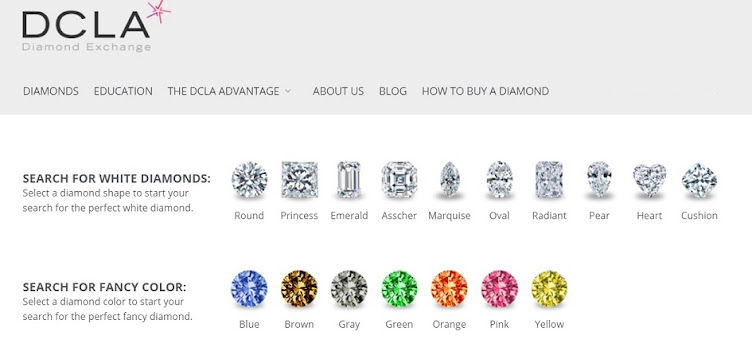

The Marsfontein mine was operated for two years in the late 1990s, with a payback of its entire development costs in less than four days. The mine’s grade was 172 carats per hundred tonnes, at a bottom cut-off of more than 1.2 mm, containing many fancy coloured diamonds.

The surrounding deposits in question were overlooked when the mine was closed.

Diamond miners are struggling across the board, especially those producing cheaper and smaller stones where there is an over-supply in the market.

Buyers, those that polish and cut diamonds for retailers, have been hit this year by lower prices and tighter credit, prompting them to delay purchases.

De Beers, the world’s top diamond producer by value, has responded by axing production — with a target of 31 million carats this year compared with 35.3 million in 2018.

It has also announced it would spend more on marketing. At the latest sale, the company increased the amount of stones buyers were allowed to reject in each lot purchased from 10% to 20%, according to people familiar with the auction.

Source: DCLA