Sales performed below expectations for Tiffany & Co during the first quarter of 2019.

For the three months ended April 30, worldwide net sales fell by 3% to $1bn compared to the previous year, and comparable sales declined by 5%. On a constant exchange rate basis, net sales were equal to the prior year and comparable sales declined 2%.

Net earnings came in at $125 million, 12% lower than the prior year’s $142 million.

These results reflect mixed performance across regions and product categories.

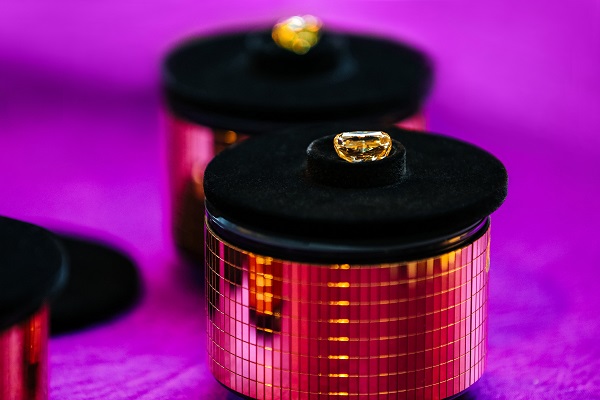

During the quarter engagement rings sales decline by 6%, while jewellery collections saw a 1% increase.

Totally net sales declined in the major markets, with Europe and the Americas both reported a 4% decline, with the latter being impacted by lower spending from foreign tourists. In Asia Pacific total net sales fell by 1%, something the brand attributes to the effect of foreign currency translation.

As a result of Q1, Tiffany has trimmed its earnings outlook, now expecting earnings in the 2019 financial year to increase by a low to mid single digit percentage, compared with its previous forecast for a mid single digit percentage increase.

Tiffany’s chief executive officer, Alessandro Bogliolo, reports: “Our first quarter results reflect significant foreign exchange headwinds and dramatically lower worldwide spending attributed to foreign tourists. That said, we were pleased that, at the core of our business, global sales attributed to local customers, led by sales in China, grew over last year’s very strong sales results.

“We believe this growth in sales to local customers reflects progress in executing our strategic priorities, including innovations across products, communications and the customer experience, and that Tiffany is positioned for improving trends in the second half of 2019.”

Tiffany opened two company operated stores in the first quarter, closed two stores and relocated two.

At April 30, 2019, the Company operated 321 stores (124 in the Americas, 89 in Asia-Pacific, 56 in Japan, 47 in Europe and five in the UAE), versus 314 stores a year ago (123 in the Americas, 87 in Asia Pacific, 54 in Japan, 46 in Europe and four in the UAE).