The RapNet community has voted overwhelmingly against introducing services for the lab-grown-diamond sector.

Members voted by 79% to 21% against the trading platform listing synthetics on the site. They also rejected a lab-grown price list, with 74% voting “no.”

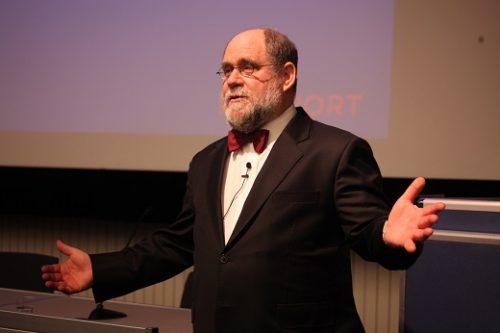

The poll took place on RapNet last week. The audience applauded when Martin Rapaport, Chairman of the Rapaport Group, revealed the results Sunday at the annual Rapaport Breakfast at JCK Las Vegas.

Following the results, RapNet will not provide a trading platform for synthetics, or introduce a price list for the product, Rapaport confirmed. “We believe the current prices for synthetic diamonds are artificial, as they are based on misleading disclosure,” he added.

Voters also heavily backed the view that synthetics producers must disclose post-growth treatments, and supported the establishment of an organization for the natural-diamond industry.

RapNet vote results:

Should RapNet list synthetic diamonds?

Yes: 1,607 (21%)

No: 5,934 (79%)

Yes: 1,607 (21%)

No: 5,934 (79%)

Should Rapaport publish a synthetic price list?

Yes: 1,885 (26%)

No: 5,232 (74%)

Yes: 1,885 (26%)

No: 5,232 (74%)

Should synthetic diamonds be required to disclose treatments?

Yes: 5,892 (88%)

No: 819 (12%)

Yes: 5,892 (88%)

No: 819 (12%)

Would you support establishment of a natural-diamond organization?

Yes: 5,528 (85%)

No: 1,104 (15%)

Yes: 5,528 (85%)

No: 1,104 (15%)

Source: Rapaport News