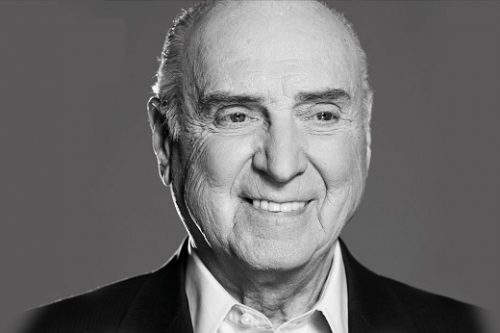

Leo Schachter, whose famed international diamond company has borne his name for almost 70 years, has died.

Schachter launched Beck and Schachter Company on New York’s 47th Street in 1952, having learned the trade from his father, Max. The firm became a De Beers sightholder in 1966, and expanded beyond the US to Israel, Africa and the Far East.

It remained a family business, with many of Schachter’s five daughters and five sons-in-law becoming involved. The company moved its main sales and distributions to Tel Aviv in 1982, and in 1984 opened a cutting factory in Botswana. In 2016, the firm — now simply called Leo Schachter — joined Alrosa’s contract-sales program.

“[Schachter] looked you straight in the eye, didn’t say that much, but quietly knew everything,” said Martin Rapaport, Chairman of the Rapaport Group. “He was straight and his advice, soft-spoken, was honest and good. He was generous with his wisdom. Someone you could look up to. I liked him and he liked me. Leo’s passing represents the end of a generation of great diamantaires.”

Schachter was an “icon of the diamond industry” and a longtime member of the Diamond Manufacturers & Importers of America (DMIA), added Ronnie VanderLinden, the DMIA’s president, in a statement.

Source: Diamonds.net