The London-listed miner, which reported a sharp increase in annual profit thanks to record recoveries of large diamonds, said it had decided to strengthen its balance sheet rather than pay a dividend,“following a review of the current state of the global market.”

The company’s stock dropped as much as 7.8% to 88.6p on the news and was still trading lower (-6.25%) in London mid-afternoon, extending its year to date decline to around 19%.

The diamond miner reported a sharp increase in annual profit thanks to record recoveries of large stones, but decided to strengthen its balance sheet rather than pay a dividend.Gem Diamonds reported a profit for the year of about $47 million, significantly more than the almost $21 million achieved, before exceptional items, in 2017.

Underlying earnings before interest, taxes, depreciation and amortization increased from $48.6 million in 2017 to $82.3 million in 2018, while earnings a share surged from 6.56c to 18.8c in the same period.

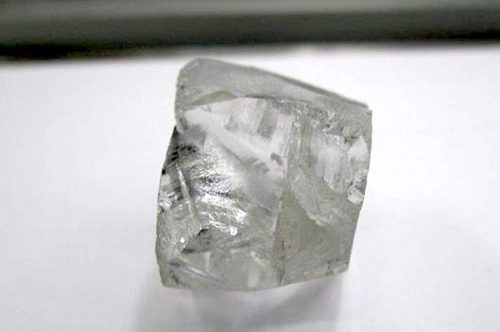

Gem Diamonds recovered 126,875 carats from its flagship Letšeng mine in Lesotho, the world’s highest dollar per carat diamond mine. Average value achieved was $2,131/ct or 10% more than the previous year.

The miner gets 80% of its revenue from diamonds larger than 10 carats, and 11% of its income comes from diamonds ranging between five and 10 carats in size. The balance of revenue is brought by smaller diamonds.

Thanks to that structure, it was not as exposed to the effects of weak prices and demand for tinier, lower-value stones as its peers, including De Beers, Alrosa and Petra Diamonds.

Gem, in fact, sold a total of 125,111 carats during the 2018 financial year, generating revenue of $267.3 million.

Letšeng mine produced a record 15 diamonds larger than 100 carats, including its largest ever diamond, the 910-carat “Lesotho Legend”, which sold for $40 million. The precious rock was the fifth largest ever found.

Since acquiring the operation in 2006, Gem Diamonds has found five of the 20 largest white gem quality diamonds ever recovered, which makes the mine the world’s highest dollar per carat kimberlite diamond operation.

At an average elevation of 3,100 metres (10,000 feet) above sea level, Letšeng is also one of the world’s highest diamond mines.

The biggest diamond ever found was the 3,106-carat Cullinan, dug near Pretoria, South Africa, in 1905. It was later cut into several stones, including the First Star of Africa and the Second Star of Africa, which are part of Britain’s Crown Jewels held in the Tower of London.

Source: DCLA