De Beers’ earnings fell in 2018 due to the costs of new initiatives such as its Lightbox synthetics business.

Underlying earnings slid 34% to $349 million, as capital expenditure rose 53% to $417 million for the year, the company reported Thursday. That included outlays related to the launch of De Beers’ lab-grown jewelry brand, as well as its Tracr blockchain program, and Gemfair, which aims to help artisanal miners. It also spent more on marketing, exploration and evaluation in Canada.

Volatile conditions also negatively affected margins in De Beers’ trading unit, it added. Consumer demand for diamond jewelry was strong in the first half, but faltered from July onward amid political uncertainty, unstable stock markets, and the US-China tariff dispute. Manufacturers bought less rough as a result.

“In the second half, the low-priced-product segment came under considerable pressure due to weak demand and surplus availability, the rapid depreciation of the rupee, and a reduction in bank financing in the midstream,” De Beers explained.

Revenue still increased 4% to $6.08 billion for the year, driven by strong consumer demand in the first half, with prices growing 1% on a like-for-like basis. Sales of rough diamonds grew 4% to $5.4 billion, while the average selling price climbed 6% to $171 per carat, reflecting lower sales of cheaper goods in the second half. Sales volumes dropped 4% to 33.7 million carats.

De Beers noted an improvement in sales at De Beers Jewellers, its high-end consumer chain. Revenue from Element Six, its industrial-diamond subsidiary, dropped 5% due to lower sales to the oil-and-gas market.

The company expects some of the group-wide challenges to continue this year.

“The outlook for 2019 global diamond-jewelry consumer demand faces a number of headwinds, including the risk of a potential intensification of US-China trade tensions, the Chinese government’s ability to rebalance economic growth towards consumption, and further exchange-rate volatility,” it said.

De Beers maintained its production forecast of 31 million to 33 million carats for this year, down from 35.3 million carats in 2018. However, profitability could suffer as output from its wholly owned Venetia mine in South Africa enters a lull this year amid a transition from open-pit to underground mining. A larger proportion of production will, therefore, come from mines in Botswana and Namibia that it operates in joint ventures with governments.

Those businesses generate lower margins than it receives from deposits it owns completely.

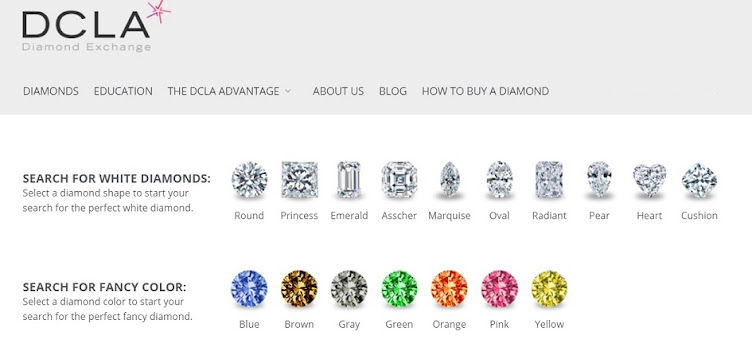

Source: DCLA