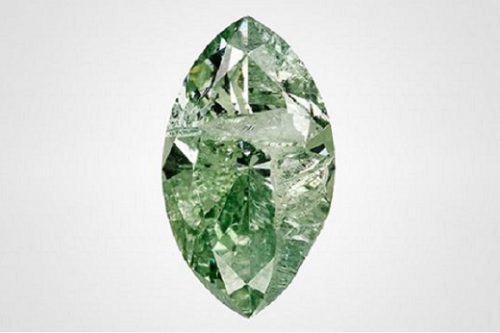

Graders noticed a large fracture and cavity on the table of the marquise-cut, 1.38-carat polished diamond submitted to the GIA’s laboratory in Carlsbad, California, for colored-diamond testing. When the gemologists examined the crack under a microscope, they noticed a gap running down the stone from the crown to the pavilion, as well as a slight misalignment in the facets and air bubbles inside the fracture.

The polish lines on the stone’s facets would have linked if there hadn’t been a fracture, GIA gemologist Troy Ardon explained this month in a lab note in the latest edition of Gems & Gemology. For that reason, gemologists determined that the stone had been broken in half after it was at least partially polished, and then repaired with an unidentified adhesive.

“Diamonds have been adhered together with glue to form a diamond-doublet, but a broken diamond that has been repaired was not something previously reported by GIA,” Ardon added.

The GIA couldn’t grade the diamond because the 4Cs wouldn’t apply to it, the note continued. A carat weight would have been meaningless, as it would have comprised the weight of both halves plus the adhesive.

Image: Robison McMurtry/GIA