The early to mid-2000 proved to be the heyday for

Australian diamond selling sites. At its peak, there were a few major re-listing sites – MDX

or diamond exchange, Diamond Specialist, Wholesale Diamonds and Jogia amongst

others.

The early to mid-2000 proved to be the heyday for

Australian diamond selling sites. At its peak, there were a few major re-listing sites – MDX

or diamond exchange, Diamond Specialist, Wholesale Diamonds and Jogia amongst

others.

Diamonds sold by these sites in Australia originally competed

with chain stores and high end retailers. Nowadays, the popularity of these sites

has dramatically declined.

At least one

of the aforementioned sites has been liquidated and reopened under new

ownership, but not before taking millions of dollars from customers and

suppliers around Australia.

The reasons for this decline is not because of the

quality of the diamonds, which are generally just same diamonds re-listed off Rapnet

or other industry platforms. BUT as the diamonds are not owned only offered by these

sites and merely re-listed at varying mark-ups. Consumers have caught on to the methology.

Also feeble attempts at simulating a

type of cut by using the words “Fire” in the brand name hasn’t been successful

in fooling discerning public into thinking it’s an actual brand like “Hearts On Fire”.

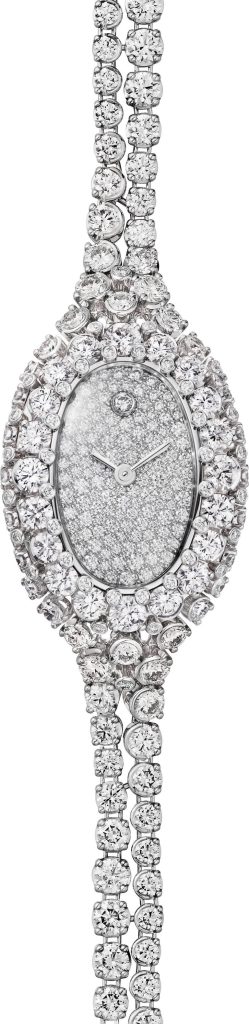

Most of these sites simply don’t market their services

well enough. It’s one thing to set up a site with fancy looking pictures and

logos, but it’s another thing to build trust with consumers. One site is the

same as the other, with all the same diamonds. Professionally designed pages

with shiny graphics, international recognition, pictures of bogus marketing

equipment and numerous media links were part of a superior marketing strategy

that built trust with consumers. At one

stage, MDX looked like becoming the Australian version of BlueNile.com.

However, their marketing strategy was perhaps too good - it alienated a lot of

wholesalers, retailers and jewellers, not because they were wrong, but because

of the way they priced the diamonds. Eventually, a series of mis-steps on their

part set in motion their bankruptcy.

The rise of www.bluenile.com is commonly cited as the

main reason for the decline of Australian local sites. The reason behind this

is that consumers are at least looking to the internet to research, and buying

a diamond or diamond jewellery and 99% of the internet sites will be cheaper

and better without any question. Secondly, Blue Nile’s expansion has allowed a

massive decrease in turnaround times In the US and around the globe including Australia.

That meant a diamond manufactured and listed only on the Blue Nile today could

be on your finger in five to seven days.

Lastly, for the most part because Australian sites simply re-listed the same diamonds and didn’t innovate or create a point of differentiation, they are simply compared on value added costs.

Whilst Blue Nile only list goods which are made available

by the factories to the company, and nowhere else, The rest of the sites list diamonds

off a common data base. Simply their only differences are the margins added to their prices.

Australian sites could have done better, but

unfortunately, like sheep followed each other by simply re-listing someone else’s

diamonds, which from a consumer’s perspective, is possibly is the worst way to

buy.

Whilst Australian diamond listing sites still exist, some are a shadow of

their former selves. Even though overseas diamond sites now dominate the

industry, these sites play diminishing role in diamonds.

In Australia there are two sites where the diamonds listed belong to the site owners, they are GP Israel and Diamond Imports.

Source: Diamond man USA